May 2023: The European hotel industry taking off again

In Europe as a whole, the hotel industry posted 20% growth in RevPAR relative to the pre-crisis period (vs. May 2019), driven by +23% growth in ADRs. While ADRs continue to rise, the gap in occupancy is narrowing; the hotel industry is still only 1.9 points behind May 2023 relative to May 2019.

Confirmed by the return of international clientele and events, the European upscale segment is now only 3.8 points behind its pre-crisis level. However, thanks to higher ADR in this segment, RevPAR was able to record a 20.7% increase.

The midscale and economy segments posted growth of 18.7% and 19% respectively, while the budget one was ahead by 25.9%!

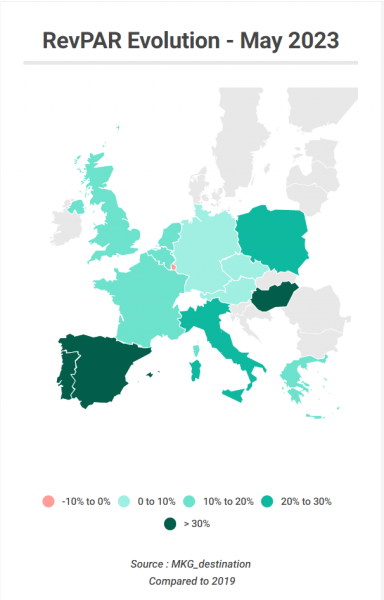

On a country-by-country basis, the hotel indicators are in fine fettle! Only Luxembourg and Switzerland posted negative performances in terms of recovery (-5.5% and -5.8% for RevPAR growth).

The fine weather and the return of leisure and international clientele led Italy to post a 43.3% increase in activity: the country posted growth of 0.9 points in terms of occupancy and 41.6% in terms of ADR.

Portugal is also doing very well this month. Although it has not yet returned to its May 2019 occupancy level (-3.9 points), thanks to a rise in the ADR, its RevPAR is up 31.5% ahead of France, which is also posting 28.8% activity growth thanks to a +1.2 point rise in occupancy – the Hexagone is thus recording the best performance in terms of occupancy growth this month among its European counterparts.

Greece came in 4th, with +25.7% growth, ahead of Hungary, which continues to suffer from the high inflation affecting the country.

While Spain is usually among the leaders in activity recovery, relative to May 2019 its

recovery is not as encouraging as that of its southern European neighbours (+15.9%).

The UK and the Netherlands are both reporting +17.3% RevPAR growth, driven by higher

ADR (+22.5% and +19.2% respectively), while Germany and Austria are a little behind the curve, still lagging behind by -4.9 and -7.2 points respectively.

May’s continent-wide figures, once again driven by Southern Europe, point to good prospects for European tourism this summer.