October 2022: Indian summer benefits the European hotel industry

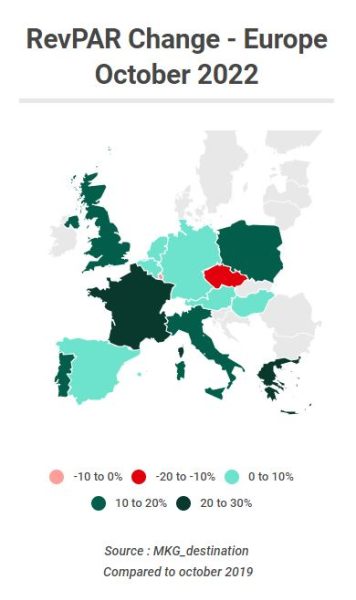

Inflation, the energy crisis and geopolitical conflicts could have penalised the European hotel industry in October, but it appears that the hotel industry was instead able to ride the heatwave of the Indian summer. October benefited from both leisure customers in Southern Europe and business customers in other countries. While some countries are still in the red, in general the European hotel industry is back on its feet with RevPAR increases of more than 20% in some countries.

Last year at this time, some countries were locking down. Today, most of the European countries are recovering. In fact, in October, the European hotel industry posted a RevPAR higher than before the crisis, with growth of 13.8%. This dynamic is still being driven up by average prices: the average price differential versus the pre-Covid period continues to increase, with a +19.2% differential in October, versus October 2019. However, occupancy rates are also on track across Europe, with a gap of only -3.5 points compared to the pre-crisis period.

And in this back-to-school season, France is leading the way with RevPAR up 22.4%, relative to October 2019, followed by Greece (+21.2%). While Greece is benefiting from the last of the leisure customers from the Indian summer, France is leading the way with the return of business customers to major cities and leisure customers from the Hallowe’en holidays.

Behind these two European drivers, Portugal, the United Kingdom, Italy and Poland are also showing remarkable momentum, with RevPAR growth of between 15% and 20%. While Southern Europe justified this dynamic by a summer season that extended into the off-season, the United Kingdom relied on the fall in the value of the pound, which strengthened the country’s appeal to international tourists.

While Spain posted positive results (8.4% increase in RevPAR thanks to a 13.3% increase in average prices), the country is still well below the performance of its neighbours.

Germany (8.1%), Austria (3.4%), Belgium (2.6%) and the Netherlands (6.6%) managed to post increases in RevPAR relative to 2019, although their occupancy is still slightly behind (between -9.1 points and -6 points). This dynamic is therefore explained by price growth of between 10% and 20%. Although these countries have long posted negative results, their recovery seems to be confirmed thanks to the gradual return of business and international clients.

Unfortunately, not all countries have managed to return to their pre-Covid standards: while Latvia is finally moving into the green, the Czech Republic is still on the sidelines with an activity gap of -16.5% in RevPAR.

Switzerland and Luxembourg are also in the red this month, as they are largely dependent on business and international clients.

With the return of foreign customers and the mix of leisure and business customers in October, performance was uniform across all segments, with increases in RevPAR of between 13.5% and 14.3% relative to the pre-Covid period. While the high-end segment is putting its prices up more (+23.2% vs. 2019 vs. around +16% on the economic and budget segments), in terms of footfall, the budget segment is doing best with a gap of only -1.7 points vs. October 2019, compared with a negative 6-point gap for the high-end segment.

Despite a period of uncertainty for the industry (energy crisis, geopolitical conflicts and other social movements but also and above all the labour shortage), at this stage the European hotel industry is managing to maintain a solid level of activity. Reservation rates for the coming weeks are good, and school and public holidays as well as the return of professional events should maintain the momentum in November.