November 2022: European hotel industry slows down its recovery

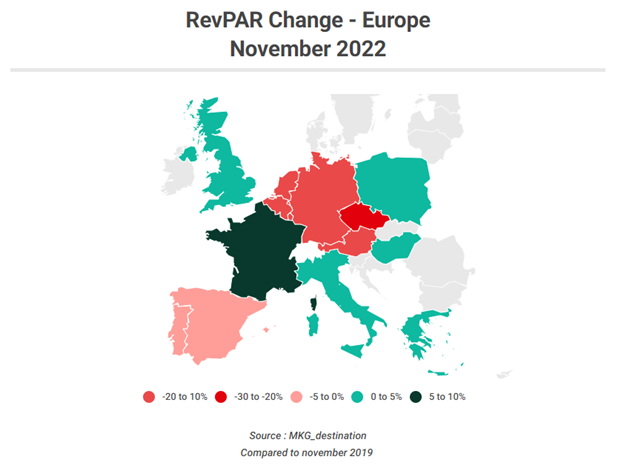

After a still “summery” October that resulted in strong performances, the recovery momentum seemed to be losing steam slightly in November. Although a number of countries managed to post RevPAR levels above 2019, others such as Germany, Austria and the Benelux countries even slipped back into the red this November. Flu epidemics, the return of Covid, geopolitical instability, the timid return of foreign customers, the change of season; could the health of the European hotel industry be under threat once again?

Overall, the European hotel industry posted higher RevPAR in November than before the crisis, with growth of +3.5%, a positive result but one that had been more encouraging recently. Momentum continues to be driven by average daily rates: the ADR change versus the pre-Covid period shows a +12.2% difference in November versus November 2019. The occupancy rate also remains correct on a European scale with a gap of only -5.5 points compared to November 2019.

With the exception of Hungary, Southern Europe is still posting the best recovery performances with Portugal also posting a 14.6% increase in RevPAR this month compared to the pre-COVID period due to a 24.2% increase in ADR, while Greece posted a 14.2% increase thanks to a 12.2% increase in ADR. However, it should be noted that Greece is also the only country to have achieved better occupancy rates than before COVID, with an OR up 1.1 points vs. November 2019. Spain and Italy are less ahead of the curve, with RevPAR up 8.6% and 5.4%, respectively, compared to pre-COVID, driven by ADRs up 18.7% and 16.9%, while occupancy rates are still 4.3 points below pre-crisis standards in Spain and 8 points below pre-crisis standards in Italy.

The United Kingdom performed particularly well this month, with RevPAR at +12.6%. While, as elsewhere, the ADRs supports this increase, the UK’s occupancy rate is also close to 2019 levels (a difference of only 2.1 points).

France is also more or less back on track in November, with a similar difference from 2019 as the UK (-2.6 points). However, the country had managed in previous months to exceed pre-COVID levels and is therefore not performing as well this month (vs. 2019).

But France is not to be pitied compared to its neighbors: whether it be the Benelux countries, Austria or Germany, none of them managed to recover their activity in November. Germany still shows a gap of -8.8% in terms of RevPAR compared to November 2019, Austria -0.9% while the Netherlands and Belgium show declines of -0.2% and -5.8% respectively. Luxembourg is one of the European countries still suffering the most with an estimated RevPAR gap of -13.8%. While occupancy rates are still lagging (approximately -10 points compared to November 2019) due to the dependence of these countries on international and business customers, average prices have not grown significantly either: only +0.4% in Luxembourg and 6.4% in Germany. On the other hand, they were more significant in Austria and Belgium, at around 15%.

November was not a transcendent month for the European hotel industry, but the results are satisfactory given the situation: epidemic period (flu and return of Covid), geopolitical conflicts, social movements, inclement weather… Will the Christmas vacations be able to give European hoteliers a boost?