December 2022: The European hotel industry ends the year on a high note

Usually subject to low or even negative temperatures, the month of December had for the past two years also resulted in freezing results in the hotel industry. The trend was quite different this year: Europe set records for temperatures during the holiday season, and the European hotel industry wanted to follow the same trend! While November showed a slight slowdown in hotel activity, December 2022 once again showed an upward trend.

Overall, the European hotel industry posted a RevPAR in December that was higher than in the pre-crisis period, with growth of +13%, a positive result that is much more encouraging than in the recent past: November showed a gap of “only” +3.5% vs. November 2019. The dynamics still driven up by ADR with a gap versus the pre-Covid period of +19% confirms the still rising price dynamics. However, let’s not forget that occupancy rate is also improving with a gap of only -3.4 points vs. December 2019.

As a result, since December’s performance is good, it supports the full-year dynamic: the European hotel industry is now only -1.1% behind in terms of RevPAR relative to pre-crisis (with a gap of -8.4 points for occupancy and a +11.8% lead in terms of ADR).

And in this last month of 2022, all ranges are doing well: the upscale market is recording a 13.9% increase in RevPAR, while the midscale one is showing the “weakest” growth, which is still 11.3%! In terms of footfall, the upscale segment is lagging the most (-5.5 points) but the difference with the other segments is now minimal.

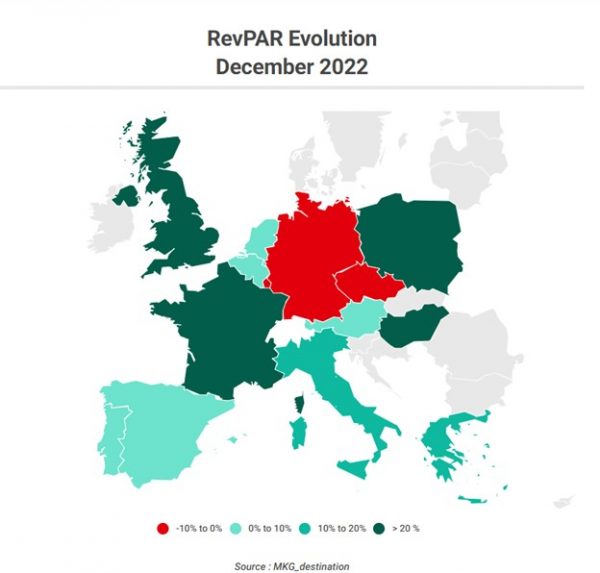

Poland recorded a 24.5% increase in hotel activity in December due to its average daily rate, which rose by 24.8%, but also due to the fact that hotel occupancy has almost returned to its pre-cold war levels (-0.2 points).

France and the United Kingdom followed with strong performances in Western Europe, with RevPAR increases of 23.3% and 22.2% respectively. While their average daily rate increases are similar (around 23% compared to December 2021), France has exceeded its pre-covid attendance in December (+0.2 points) while the UK has not yet quite reached it (-0.2 points). It should be noted, however, that France’s performance had been impacted in 2019 by the “gilets jaunes” crisis in particular leading to low performance levels in December 2019.

Southern destinations such as Italy and Greece also performed well last month with +16% and 18.8% RevPAR driven by good results in terms of occupancy (Greece shows +2.4 points of additional occupancy compared to pre-crisis, a record on a continental scale) but above all by an increase in prices.

Further north, Austria, Belgium, the Netherlands and Switzerland are exceeding their activity levels relative to December 2021. Their RevPAR increases of between 2.3% (Austria) and 9% (Belgium) are justified by average daily rates increases of between 13.3% and 21.6%. However, having long suffered from considerable delays in occupancy, we can now estimate that even in terms of occupancy rates, the results are good (more than 8 to 5 points difference in occupancy).

But while the dynamics are very good for these countries, Luxembourg (-9%) Germany (-5.7%), Latvia (-5%) and the Czech Republic (-5%) are still unable to record positive developments this month (vs. December 2019). In general, average daily rates tend to follow a less strong dynamic than all other European countries and visitation in these 4 destinations remains at levels 5 to 10 points lower vs. pre-Covid.

However, on a national scale, as we approach 2023, the European hotel industry seems to definitely recover. December’s performance proved that the sector is recovering in almost all countries. However, it is important to note that December benefits from the end-of-year holiday, so will the European hotel industry be able to follow the same recovery dynamic in January?